In 2020 American Fidelity Assurance Company, the flagship Company of the Cameron family of companies, celebrated 60 years of providing a different opinion to our Customers.

In 2020 American Fidelity Assurance Company, the flagship Company of the Cameron family of companies, celebrated 60 years of providing a different opinion to our Customers.

OFFERING A DIFFERENT OPINION IN UNCERTAIN TIMES

I’m proud of the way our Colleagues rose to the challenges of serving our Customers during a pandemic. Our Colleagues adapted to the changing landscape of business and found ways to support our Customer groups as well as individual policyholders. Whether it was donating personal protective equipment to healthcare workers and teachers or finding innovative ways to continue to meet with them one-on-one, our Colleagues were up to the challenge.

FORWARD THINKING

Through technological innovations, Colleagues helped American Fidelity prosper and more importantly faithfully serve our Customers and sustain our business interests in 20 countries around the world.

WE ARE FOCUSED ON MAKING THINGS EASIER FOR OUR CUSTOMERS

This dedication to serving our Customers reminds me of my grandfather’s determination to serve others. Once, my grandfather and his partner called on a farmer to make a sale. The farmer said he was too busy chopping cotton to talk, so my grandfather took his place, working in the field, while his partner made the sale to the farmer to help protect his income in case of an injury or accident.

That’s the same spirit we continue to bring to our work at American Fidelity. And it’s how we’ve earned recognition from industry ratings agencies like A.M. Best as well as workplace evaluators like Fortune magazine and the Great Place to Work Institute. See other awards and industry recognitions we have earned.

OUR CUSTOMERS DESERVE A SPECIALIST

Our amazing team of Colleagues is focused on understanding the unique needs of our niche-market Customers and finding new ways to offer a different opinion to serve their growing and changing needs. We’re proud to have been serving you for more than six decades, and we look forward to the next 60 years and beyond.

2020 WAS A YEAR UNLIKE ANY other, not only for American Fidelity, but for all of us. AF began the year with a focused plan for innovation and growth. In March, those plans changed significantly as we saw our nation shut down in response to the COVID-19 pandemic. Although no one can completely be prepared for the magnitude of events that a global pandemic brings, thanks to our preparedness, American Fidelity reacted quickly and with minimal disruption as our Colleagues transitioned to working remotely. The year changed our daily lives, both at home and at work.

2020 WAS A YEAR UNLIKE ANY other, not only for American Fidelity, but for all of us. AF began the year with a focused plan for innovation and growth. In March, those plans changed significantly as we saw our nation shut down in response to the COVID-19 pandemic. Although no one can completely be prepared for the magnitude of events that a global pandemic brings, thanks to our preparedness, American Fidelity reacted quickly and with minimal disruption as our Colleagues transitioned to working remotely. The year changed our daily lives, both at home and at work.

During this time, we focused on the struggles our Customers were facing. We knew we had to innovate quickly in order to provide the same level of service our policyholders expect. All told, we were able to continue delivering on our commitment to our Customers. We paid out benefits as fast or faster than before. We innovated through technology to conduct enrollments and connect to our Customers through virtual platforms and in-person with personal protective equipment. We remained flexible to address their needs and navigate through the unknown, understanding that any given day could change the best-laid plans.

Against the backdrop of the pandemic, Social Justice became front and center as organizations began examining their cultures. American Fidelity began working with a Diversity, Equity and Inclusion (DEI) consultant to gain Colleague feedback and to guide and provide insight to best practices that will help our organization grow. We are committed to taking steps to work together in an effort to end systemic racism and inequality and build an even better America. The strength of our country, our community and our Company lies in our differences. Learn more about our commitment to diversity, equity and inclusion.

Despite the numerous issues presented by COVID-19, American Fidelity ended the year with strong revenue growth while holding our expenses to planned levels. This resulted in higher than expected net income growth.

As we move into 2021, we will take what we have learned and become more resilient. We believe there is always value in looking back to remember what we’ve lost, what we’ve gained and how we can improve.

and November

- AFES will focus on attracting new employer and employee Customers in our voluntary markets and work to create strategic partnerships aimed at relieving employer pain points.

- We will use data analytics to improve sales and expense management efficiencies.

- We will focus on business plan execution and accountability for all sales areas.

- AFES will leverage critical partnerships to provide value with employer-based solutions.

- We will continue to focus on adjustments to employer consumption preferences and improve online sales capabilities.

- AFES will also expand service offerings and simplify our insurance products.

- We will work to enhance our capability of offering multiple types of enrollments (virtual, call center, in-person, etc.).

- AFES will work closely with our marketing team to enhance our communication resources.

- In 2021, we will work on effectively mapping out more robust and engaging virtual learning and development programs in place of in-person training.

- AWD finished 2020 strong with increased sales per Customer for virtual enrollments.

- We established a stronger foundation emphasizing Customer value and focusing on making employers’ lives easier.

- AWD shifted our focus to larger groups and re-focused on our employer value proposition.

- AWD will continue to build a strong core foundation to establish consistency and a predictive future.

- The division continues to implement Challenger training for our sales Colleagues with an emphasis on value to the employer to enhance their experience and make their lives easier.

- Everyone is involved in continued focus on new account development and using OKRs with quarterly accountability.

- Due to higher-than-expected loss ratios in 2019, we targeted a decrease in earned premium of 11.4% from higher rate increases and tighter underwriting standards, on both new and existing stop loss business.

- 2020 marked the third full year of our AF Direct stop loss sales and operation model. Although our Managing General Underwriter (MGU) production declined in 2020, we maintained stop loss distribution relationships with a number of quality MGUs. Total earned premium for all products were under budget with a decrease of 17.7% versus a target of an 11.4% decrease.

- We were very successful in our goal of improving profitability. The higher rate increases and tighter underwriting standards on both new and existing stop loss business allowed us to significantly exceed our ROE target for 2020.

- Strategic Alliances’ earned premium target is a decrease of 2.6%. The decrease is a result of no Medicare Supplement premium due to cancellation of that program in 2020, continued decline in the MGU business offset by 10% increase in the direct stop loss premium. We continue to focus on profitability with higher rate increases and tighter underwriting standards. Our move to the direct stop loss model gives us more control over loss ratio management, underwriting control and expense management as it becomes a larger part of our total business.

- Within American Fidelity, we are continuing to build on distribution relationships with our Association Worksite Division (AWD) and American Fidelity Educational Services (AFES) division that have already created new sales and show excellent promise for future collaboration.

- This year will remain a dynamic legislative and regulatory period. We will continue to respond effectively to evolving client needs. We look forward to our ability to leverage the unique qualities of AF in creating prompt solutions for our partners and clients.

- Implemented AFService (CRM) for our contact center, which allows our Customer advocates to:

- Know who is calling before they answer

- Have all of the Customer’s information in one place and readily available

- Eliminate the need to swivel to many other systems to solve the Customer’s issue

- Provide pre-structured email templates so we can more quickly respond to emails

- Help us reduce our non-phone Customer communication turnaround time

- Implemented Pregnancy Quick Claims, which allows Customers to file pregnancy claims via the OSC and in many cases allows for a very fast claim payment turnaround

- Have 24 robots aiding in our processing

- Implemented a new self-service system for our Health Savings Account (HSA) participants to move money to invest and manage their investments online

- Implemented Online Billing Reconciliation

- Rolled out Own It! model in Operations, which included a Colleague virtual conference to help focus on proactive service rather than reactive

- Moved all Colleagues to a remote work environment temporarily due to COVID-19, onboarded and trained new Colleagues virtually while maintaining Customer service standards

- Expanding and enhancing use of AFservice to improve the Customer experience

- Creating five-year technology and workforce plans

- Continuing work on our annuity platform and strategy

- Adding reimbursement functionality for card repayments

- Making ongoing enhancements to our online billing reconciliation process to expand and improve the Customers’ experience

- Implementing online claims tracker capabilities for our Customers/policyholders

- Working toward using optical character recognition

- Enhancing our Policy Administration Systems

In 2020, we developed a new Infectious Disease Rider on our Group Critical Illness product that adds important coverage for many different diseases including COVID-19. We had good speed to market with this benefit enhancement and early sales results are encouraging. We also improved the enrollment experience for our Life Insurance products, which significantly enhanced the Customer enrollment experience. Early results indicate great Customer acceptance and a positive impact on our Life product sales.

Paid Family Medical Leave (PFML) at both the state and federal levels remains a focus for us, and we are developing our own PFML program as well as strengthening our Disability products to provide paid leave benefits and also better coordinate with the government-mandated leave programs. We will respond with viable solutions and continue to educate our employer groups on the choices they have to provide the best paid leave benefits for their employees.

- Rollout of Pregnancy Quick Claims

- Implemented remote signature capabilities

- Implemented the technology for our new Sales Call Center

- Supported 98% of our Colleague base working remotely

- Rolled out cobrowsing for the field

- Launched and migrated most Colleagues to Teams

- Launched the Artificial Intelligence

& Machine Learning backed version of support center chatbot - Made enhancements to automate enrollment setup processes

- Simplified the issuing process

- Implemented Online Service Center

& AFMobile login and registration process improvements

- New functionality and features for our software

- Focus on Customer and continued strong integration with the business

- Automating processes to allow for more self-service for Colleagues, Customers and policyholders

- Continued focus on data quality and availability

- Assist the field with technologies needed to support enrollments

Although we had built up our digital marketing capabilities in prior years, our demand went up as this became the only way to engage our Customers. All of our pre-enrollment materials and enrollment materials had to be converted to 100% digital engagement. We had experimented with electronic live enrollment platforms and had to make many adjustments for volume and circumstances. We worked closely with our all of our internal divisions to ensure that we maximized our effectiveness. We had daily conversations with our field staff and leadership to understand what was working and how we needed to adjust.

KEY ADJUSTMENTS THAT HAVE POSITIONED US WELL FOR 2021 AND BEYOND

- A much larger adoption rate from account managers and Customers relating to digital communication. We estimate that we accelerated our digital marketing evolution in six months what would have taken at least five years under normal circumstances.

- We accelerated our video marketing engagement ten-fold over the amount of video marketing we had in 2019. We were able to create customized videos through automation using AI and modular product and service segments.

- We created high production value video kits that could be sent out for Customer testimonials and field Colleagues. These allowed us to create new marketing collateral even during periods of quarantine. We were able to embed videos into digital proposals and keep up with our new account acquisition goals in spite of the pandemic. The fact that we were the rare provider that could continue enrollments during the lockdown periods led to us being in very high demand.

- We created new online scheduler capabilities and brought new flexibility to Customer interviews with integrated ways to enroll in our plans.

- We continued our R

& D efforts, expanding process automation and tracking pandemic-related business metrics. - We developed new benefits websites for our employer Customers that aggregated benefits information, scheduling capabilities and became a year-round resource following their enrollments.

- We developed new feedback loops through automated surveys. This highlighted that 92% of our enrollees prefer a guided experience with a live account manager.

At American Fidelity we have what you deserve: Financial security solutions and service! More relevant than the solution offerings is the excellent service that comes with them. Many companies talk about service, we provide high-quality service.

Whether it be banking, homeowners’ insurance, payroll, investment management or employer benefit solutions, we provide the solution and back it up with caring and empathetic Customer service Colleagues. One of our guiding principles is being always fair. We work hard to be fair to you: our Colleagues and our shareholders.One of the more exciting ventures we are working on is the real estate development adjacent to our corporate headquarters. This past year we have opened Flix Brewhouse and movie theater and Chicken N Pickle restaurant and pickleball venue. We will soon be opening two corporate offices. We expect to have in place additional restaurants and a hotel, with construction on an apartment building starting this fall. The entire development will further enable Oklahoma City to grow and prosper while providing an excellent venue for work or play.

INSURICA

Founded in 1959, INSURICA is among the 50 largest insurance brokers in the US, providing access to insurance coverage and risk management programs for person and commercial clients across the country.

AMERICAN FIDELITY ASSURANCE COMPANY

Founded in 1960, American Fidelity Assurance Company offers employer benefit solutions, such as expense management services, enrollment support and stop loss insurance, as well as employee benefits including disability, accident and cancer insurance.

AF ADMINISTRATIVE SERVICES (AFAS)

Founded in 2012, American Fidelity Administrative Services, LLC (AFAS) offers compliance assistance with the Affordable Care Act (ACA).

INVESTRUST

Founded in 1997, InvesTrust is a full-service retirement savings plan provider and investment management firm for individuals, families, trusts, corporate entities and charitable organizations.

FIRST FIDELITY BANK

Founded in 1920, First Fidelity Bank offers community-centered financial services and solutions for commercial and retail customers. This includes checking, loans, investments and cash management services.

AF PROPERTY COMPANY, INC. (AFPC)

Founded in 1964, American Fidelity Property Company, Inc. acquires, develops and manages real estate properties for many of the American Fidelity entities and related Cameron companies. AFPC, through a variety of subsidiaries and LLCs, provides services such as grills, clinics and fitness centers.

AMERICAN PUBLIC LIFE

Founded in 1945, American Public Life Insurance Company offers a wide variety of supplemental health and voluntary insurance products through a select group of brokers across the country.

FIRST FINANCIAL GROUP OF AMERICA

Founded in 1966, the companies of First Financial Group of America provide employee benefit solutions, administration service solutions, insurance benefit consulting and enrollment solutions for school systems, hospitals, counties and city governments.

DALLAS WINGS BASKETBALL

Founded in 1998, Cameron Enterprises purchased the Detroit Shock WNBA franchise in 2010 and formed Tulsa Pro Hoops, LLC dba Tulsa Shock. In 2015, the franchise moved to Arlington, Texas, and joined Cameron Enterprises under the name Full Court Partners, LLC dba Dallas Wings.

AMERICAN FIDELITY INTERNATIONAL (BERMUDA)

Founded in 2000, American Fidelity International (Bermuda) Ltd. offers high-quality financial protection solutions to individuals throughout Latin America and Asia through an international consultant distribution system.

ALCOTT HR

Founded in 1987, Alcott HR is an HR outsourcing solution

that includes HR compliance, administration and

technology, including payroll and taxes, employee benefits, training and development.

LIKE MOST THINGS IN 2020, philanthropy looked a little different. Instead of volunteering with our favorite organizations, we delivered personal protective equipment to healthcare workers and educators. Instead of supporting the United Way through in-person activities and tours, we learned more about the agencies via video meetings. Instead of in-person fundraising events, we supported virtual activities hosted by the non-profit agencies. Instead of donating our time, we donated more of our funds.

But even though it may look different, our dedication to the communities we serve is unwavering.

Look to our companion Community Impact Report for details on how we helped make a difference in 2020.

FORTUNE 100 BEST COMPANIES TO WORK FOR® 2020

FORTUNE BEST WORKPLACES FOR WOMEN™ 2020

FORTUNE BEST PLACES TO WORK FOR MILLENNIALS™ 2020

FORTUNE BEST WORKPLACES IN FINANCIAL SERVICES

GREAT PLACE TO WORK'S BEST WORKPLACES FOR PARENTS™ 2020

“A+” (SUPERIOR) FROM THE A.M BEST COMPANY SINCE 1982

WARD'S 50© TOP PERFORMING LIFE-HEALTH INSURANCE COMPANIES

100 BEST PLACES TO WORK IN IT 2020 FROM IDG COMPUTERWORLD AND INSIDER PRO

- Consolidated realized capital gains net of tax totaled $45 million and were driven by equity gains stemming from the appreciation in the equity markets and gains in the AFA bond portfolio driven by implementing our total return approach to managing the bond portfolio.

- AFA’s annual operating cash flows increased from $239 million to more than $355 million, reflecting the continued operating strength of AFA through the pandemic. Our $1.1 billion in consolidated liquidity provides strong financial flexibility to meet operational goals and policyholder needs.

- AFC's consistent operating strength is reflected in the 13% compound annual growth rate of GAAP equity since 2016.

- In 2019, A.M. Best assigned a group rating of A+ superior for AFA and APL. This rating was driven by our strong balance sheet and operating performance. The current expectation is that the group rating will remain unchanged for 2020.

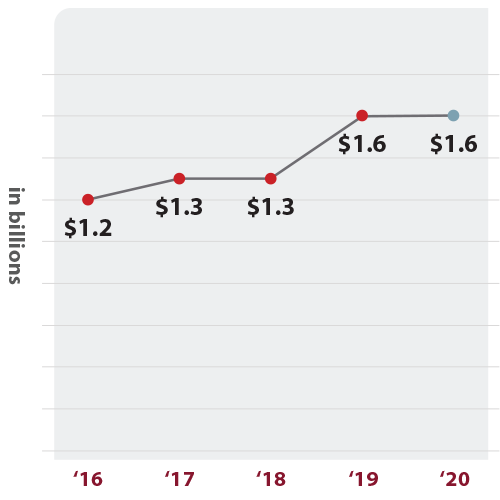

Total Revenue

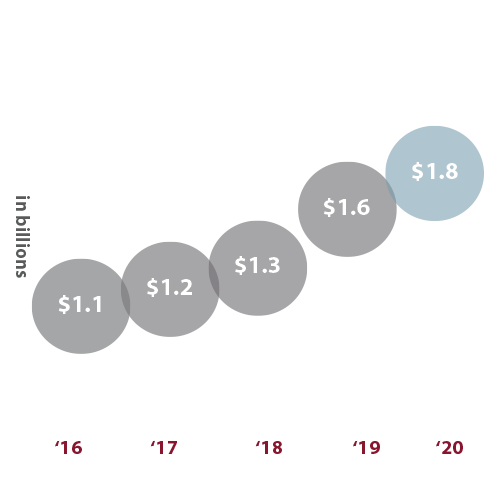

GAAP Equity

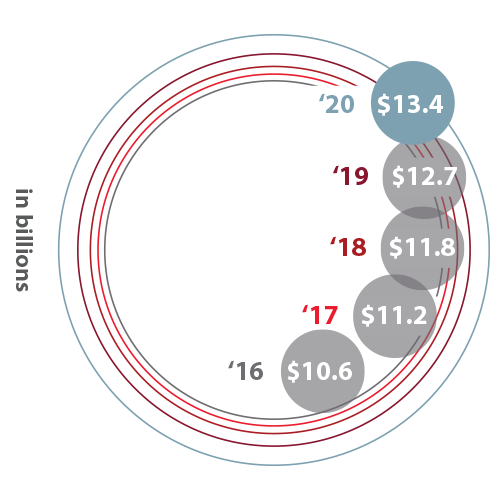

Consolidated Assets

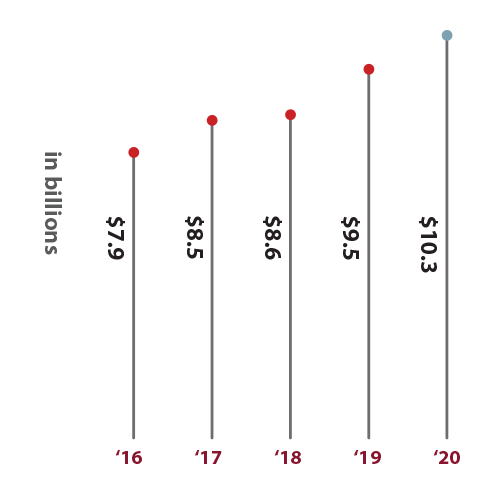

Accumulated Benefits

Paid to Customers

| Assets | 2020 | 2019 | |

|---|---|---|---|

| Cash | $330,161 | $384,541 | |

| Bonds | $4,563,970 | $4,183,762 | |

|

Preferred |

$176,630 | $147,088 | |

| Trading Investments | $889,525 | $841,266 | |

|

Short Term |

$175,115 | $29,442 | |

| Mortgage Loans | $613,567 | $553,162 | |

|

Real Estate |

$180,115 | $190,265 | |

| Accrued Investment Income | $42,050 | $42,988 | |

| Accrued Receivable | $1,133,065 | $1,186,183 | |

| Deferred Policy Acquisition Costs | $829,705 | $800,986 | |

| Other Assets | $163,023 | $167,538 | |

| Separate Account Assets | $1,164,401 | $982,333 | |

| Total Assets | $10,261,327 | $9,509,554 | |

| RESERVES, OBLIGATIONS |

2020 | 2019 | |

|---|---|---|---|

|

Policy Funds Set Aside Assure Payment of Future Benefits to Policy Owners |

$5,103,451 | $4,918,749 | |

| Unearned Premiums | $8,793 | $9,207 | |

| Notes Payable | $722,026 | $633,883 | |

|

Income Tax Liability |

$1,442,251 | $1,374,718 | |

| Separate Account Liabilities | $1,164,401 | $982,333 | |

|

Capital Surplus and Retained Earnings for the Future Protection of Policy Owners |

$1,820,525 | $1,590,780 | |

|

TOTAL LIABILITIES EQUITY APPLICABLE TO AFC |

$10,261,447 | $9,509,670 | |

| Non Controlling Interest | ($120) | ($116) | |

|

TOTAL LIABILITIES |

$10,261,327 | $9,509,554 | |

| RECONCILIATION OF CAPITAL, SURPLUS |

2020 | 2019 |

|---|---|---|

|

Capital |

$627,221 | $578,128 |

| Net Deferred Policy Acquisition Costs | $777,415 | $732,847 |

| Policy Liabilities | $31,531 | ($27,508) |

| Deferred Federal Income Taxes | ($208,863) | ($147,475) |

| Other | $498,530 | $250,436 |

|

Stockholder’s Equity of Noninsurance Subsidiaries, Net of Consolidating Eliminations |

$94,691 | $204,352 |

|

BALANCE AS DETERMINED IN ACCORDANCE WITH GENERALLY ACCEPTED ACCOUNTING PRINCIPLES |

$1,820,525 | $1,590,780 |

Greg Allen,

John Bendheim, Jr.,

Bill Cameron,

Lynda Cameron,

Bill Durrett,

Charles Eitel,

Ted Elam,

Lynn C. Fritz,

Caroline Ikard,

Paula Marshall,

Tom McDaniel,

Stephen Prescott, MD,

Henry Sohn,